Why Investors Should Favour Companies Where the CEO’s Compensation Is Mostly in Stocks Rather Than Salary

- Max Teh

- Sep 14, 2024

- 3 min read

Updated: Mar 23, 2025

Table of Contents

Disclaimer: This communication is provided for information purposes only and is not intended as a recommendation or a solicitation to buy, sell or hold any investment product. Readers are solely responsible for their own investment decisions.

KEYPOINTS

CEOs compensated primarily in stock are incentivized to drive long-term company growth, aligning their interests with shareholders.

Equity-based compensation encourages CEOs to focus on increasing the company's value, as their personal wealth is tied to stock performance.

High stock ownership by CEOs amplifies their commitment to the company’s success, especially in cases like Fortinet, Microsoft, and HubSpot.

When evaluating a company's near- to medium-term growth potential, it's crucial to understand the incentives driving its leadership. One powerful indicator of alignment between a company’s CEO and its shareholders is the structure of the CEO’s compensation. Specifically, companies where the CEO’s remuneration is heavily weighted in stock options, rather than a high salary, may present stronger growth opportunities for investors. Here’s why:

The “Salary Man” Mentality vs. Ownership Mindset

CEOs who receive a large salary but little in the way of stock compensation may operate with a "salary man" mentality. Their personal financial incentives are tied to showing up and maintaining the status quo, rather than driving the company's long-term success.

Contrast this with CEOs whose compensation is mostly tied to the performance of the company's stock. These CEOs are directly incentivized to grow the value of the company, as their own wealth depends on it.

Where to find CEOs & other C-lvl execs compensation breakdown

i) Salary.com

You can find these info on salary.com/

Search for your intended companies, look under the Executive Compensation, and search for the respective personnels

Notable Examples

Two great examples of CEOs who are aligned with their shareholders are Ken Xie of Fortinet and Satya Nadella of Microsoft.

In 2022, Ken Xie earned $16 million in total compensation, with a whopping $15 million of that in stock options.

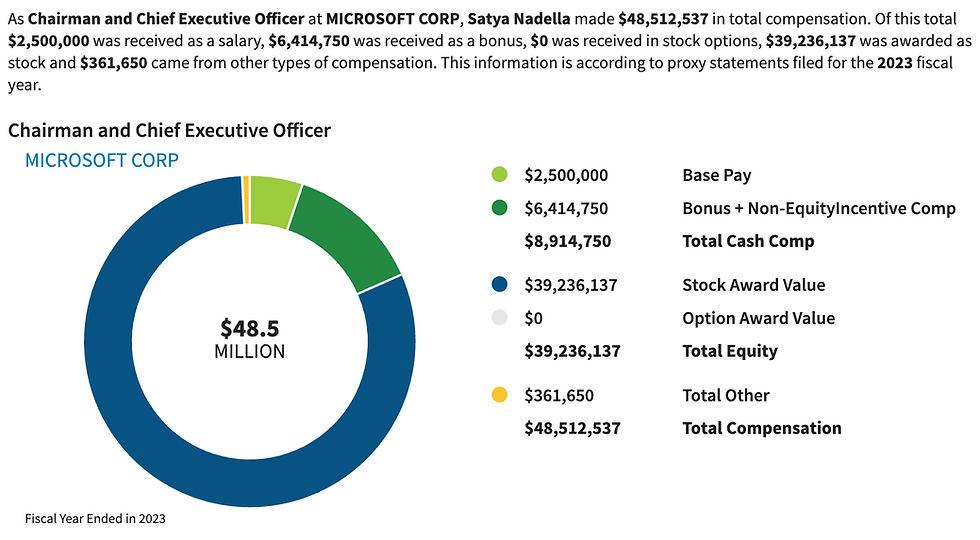

Similarly, Satya Nadella received $48.5 million in compensation, of which $39 million was in stock awards.

These setups ensure that both Xie and Nadella have a strong personal incentive to see their companies thrive in the long term, as their own net worth is tied to the company’s stock performance.

ii) Morningstar.com

Look under "Executive" > "Key Executives"

iii) Proxy filings DEF 14A

Look under "Summary Compensation Table"

For more on DEF14A, and why it can be useful for evaluating the quality of the management of a company read this blog.

Ownership Stake Amplifies This Effect

This incentive alignment is even stronger when the CEO already owns a significant amount of company stock. For instance, when a CEO has a substantial portion of their net worth tied to the company they manage, they’re more likely to be deeply invested in the company's long-term success. You can read more about why CEO ownership matters in Bet on Belief: Why Founder and C-Suite Ownership Matters.

Notable Cases in Newer Companies

In certain instances, particularly with newer or less profitable companies, a CEO may opt for minimal salary and stock awards, choosing instead to reinvest the company's funds into growth.

Duolingo's CEO, Luis von Ahn, draws a modest $750,000 salary and receives no stock options.

However, knowing that he owns 7% of the company, one could infer that he may be using stock awards as incentives for other key team members rather than himself.

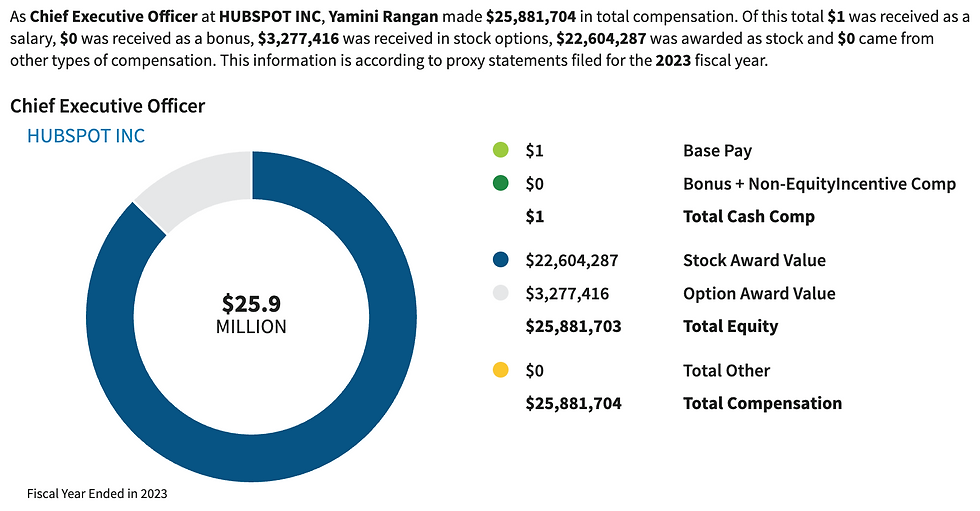

HubSpot’s CEO: A Dollar a Year, but Millions in Stock

An extreme example of this is HubSpot's CEO, Yamini Rangan, who receives a symbolic $1 salary per year, with the rest of her $26 million in compensation coming in the form of equity.

This setup not only aligns her interests with shareholders but also likely requires her to meet specific performance targets to earn the full stock award. This ensures she is constantly driven to keep HubSpot’s stock price moving in the right direction.

By favouring companies where the CEO’s compensation is largely tied to stock performance, investors can gain confidence that leadership is working to maximize shareholder value. CEOs who are motivated by stock performance are far more likely to focus on long-term growth and strategic decision-making, aligning their goals with those of investors.

Comments