How much should you invest and what returns should you aim for so you can retire comfortably?

- Max Teh

- Jan 22, 2021

- 16 min read

Updated: Apr 30, 2022

Table of Contents

Disclaimer: This communication is provided for information purposes only and is not intended as a recommendation or a solicitation to buy, sell or hold any investment product. Readers are solely responsible for their own investment decisions.

1. Why do you need to invest?

There are 2 main reasons why we should really consider investing our money: i. To prepare us for retirement: So we can achieve a level of financial stability when we choose to retire one day, it is not realistic to think that we can work forever until the day we die. We need to build a nest egg which can provide us some recurring income to support our lifestyle when we do retire one day. And with investing, perhaps that will allow us to retire earlier.

ii. To hedge against inflation

Even if you are a very high-income earner, or already have a high amount of net worth, With inflation rate of 2% per year, your net worth will be halved in 33 years time.

In many countries, inflation rate can actually be higher than 2%, hence it takes an even less amount of time for our money to be halve the value.

This is an online calculator you can use to calculate how inflation affect the value of money:

One of the main deterrent which stops people from investing is that they say “Investing is Risky”, or if they carry the mindset that if they “do not invest, they will not lose any money”, and also a popular Cantonese saying "淡淡定定,有錢(💰)剩" many Chinese may be familiar with.

What we often forget to realize is that if we do not do any form of investments, we will lose our hard-earned money for sure, since Inflation is close to inevitable. They just happen so gradually and in such intangible form that we rarely feel the pinch in the short to medium run.

Investing our money is actually a form of “damage control” against inflation.

“Investing” is only risky when what the other person really is doing is “Speculating” Speculating happens when the person “invests” in a speculative manner. When they:

Buy into companies purely based on “hear say”, “stock tips” without:

Basic understanding of the companies

When they have no simple idea about their business model and the revenue sources of the companies and their future growth potential.

Perform frequent trading (buying and selling of the same instrument) or attempting to “Time the market”

hoping to make some “quick gains”

Not having an idea on the basic financial health (amount of Debt) and performance of the companies

These actions will result in a lack of conviction in the investors’ theses for the companies they bought into, which will deter them from holding the stock long term with a sense of emotional stability.

When stock prices fall, they may panic and sell out their positions instead of dollar-cost averaging (buying more) to take advantage of the cheaper valuations.

However, with a desire to be financially-free in the future (very important requirement!), and equipped with some basic knowledge:

Contrary to popular beliefs, investing successfully is not difficult

It can be quite an enjoyable and fulfilling process, knowing that you are utilizing your hard-earned money to work hard (or in the most optimal manner possible) for you.

Often times, one of the most common remarks I’ve heard from people once they learnt some basics about investing is that they’ve only wished they have learnt it sooner and regretted not taking action (and investing) soon enough.

2. How much money do you really need to get started?

How much money do you need to get started? Assuming you are 30 years old, with 0 savings. You will need $10 a day, or $305 a month.

Invested properly over the next 36 years, you can have up to $3.96 million which will be enough for you to retire adequately.

3. First, we need to determine what is our financial goal,

If you, like most young people who are just starting your career and is working towards building your retirement funds, your investment strategy will be different to someone who is more financially established and are focused on wealth preservation.

People who fall in the latter category will choose asset groups which are more defensive in nature. ie companies which are more established, hence less volatile and may tend to pay more dividends.

This is where many people missed out on, the most important first step is to determine what are your financial goals (What are you trying to achieve financially), that will help determine your Investment goals, which will give you an idea what sort of returns you should be aiming for.

So, how much yearly returns should you aim for if you fall into the first group?

You should be aiming for at least 15% yearly returns.

With 15% yearly compounded returns, we can double our capital in 5 years’ time.

4. How much will you be worth if you invest $10 a day and compound it at 15% per year for the next 36 years?

If you invest $305 every month (or an average of $10 per day) through dollar-cost averaging method from January 2021, and compound them at a yearly return of 15%.

You capital would grow to a total of $3,961,301 by the end of your 36th year (when you are turning 66 years old).

Not too shabby at all.

This is the spreadsheet I created which you can use to perform the calculation, you just need to fill in the cells in green (*Age, *Monthly contribution amount, *Yearly targeted returns, etc) and it will auto-calculate the values for you.

I encourage you to experiment around with the figures in the file and see how much the total figures will change when you amend the figures and the total investment balance will be updated automatically and you can view the yearly balances on the next sheet.

Doing so will give you a clearer idea how much faster you can reach your goals if you either increased your *monthly contribution amount or if you increased *your yearly investment returns.

Now, although many of us would prefer to retire at an earlier age, compared to 66 years old

But let us just assume the “worst-case” scenario- which is not really that bad, especially if we have a job which we are interested in contributing towards and look forward to everyday, and we really have to work until 66 years old.

The real “worst thing” is that if we are unable to retire once we reach that age.

My most important objective of writing this article is to help you become financially self-sustainable when you reach your retirement age, so you can enjoy your golden years with a peace of mind.

Instead of needing to continue working until your elderly age - around 80 years old , or feel guilty having to rely on other family members to support you financially at that age, adding burdens to your loved ones.

If you are someone who would prefer to find jobs which are not that strenuous and more suitable for you when you become a senior citizen (i.e. 60 age and above). And do not mind having a pay cut to transition into a job which provides you more work life balance by then.

Here are some of the best part time for senior citizens,

This is also why I chose the $305 monthly contribution amount which is more sustainable even at an older age. Or when working a job which pay a lower salary.

However if you would like to fast track your journey and reach your financial goals sooner, so you can retire earlier. There are some things you can do (which I will cover at the later part of this article) on how you can achieve that.

5. Some important assumptions and things to consider beforehand.

The global average life expectancy is 72.6 years old and 82.9 for Singaporeans

With improved medical care and easier access to better nutrition in the future.

Let us play it safe and assume that you will live until 100 years old.

Which is 17 years above the average life expectancy.

And assume the worst-case scenario that you can only lead a lifestyle which costs $3,000 per month (in today’s money value) at your 100th year.

6. Your source of income which will finance your lifestyle after you retire.

Now that we have the numbers we want to achieve (that we will have enough to lead a lifestyle which cost $3,000* per month when we reach 100* years old), we can work backwards to calculate the amount we need to reach our financial goals while accounting for inflation.

First, we need to determine how much would $3,000 cost in year 2091 (presumably the year you turn 100 years old) ?

Because both the CPI and GDP deflator (measures of inflation) have been increasing at a cagr of 2% in the past 50 years, we can assume that inflation rate will continue to maintain at an average 2% per year going forward.

This means at inflation rate of 2%, it will require $12,239 in year 2091 to achieve an amount which is equivalent to $3,000 today. (Future value formula = $3,000 x (1 + 2%)^71 years)

N: 71 years is derived from year 2091 minus 2020.

This is crazy isn’t it? To be able to predict and see how expensive a mere $3,000 today will cost 70 years later.

In your 36th year of investing, your investment capital should be worth at least $3,961,301.

You have two options of:

Option 1: Close all your positions and move them into defensive assets which pay dividends.

Such as Reits, Bonds, Fixed Deposits or Dividend stocks which can yield up to 4% of pay outs per year.

Assuming if there are no capital gains for these investments and

With 4% of dividend payout out of your total capital of $3,961,301, that would yield you a monthly income of $13,204 every single month. (which is more than the required $12,239 amount to sustain your “$3,000” lifestyle when you reach 100 years old.)

Option 2: Continue to stay invested in the companies you bought into 34 years ago

If at this point if you are still holding onto most of the companies you invested in 36 years ago,

which should be way more established now and may start paying out some of their profits as dividends to shareholders.

If their underlying fundamentals are still intact- meaning, if they are still great businesses to own at that point of time (although they may not be growing (sales) at such a fast rate anymore).

They may still continue to provide up to 5% of capital gains per year,

and if you receive a 3% dividend yields from them per year.

Your investment capital will achieve up to $21,850,958 when you are 100 years old,

And you would have an average monthly income worth at least $9,903 for your retirement years from the dividend yields.

3% dividend yield is a conservative number here.

Because if you would have bought these stocks earlier at a cheaper price many years ago, your dividend yields will be much higher compared to investors who invest at a later stage at a higher price.

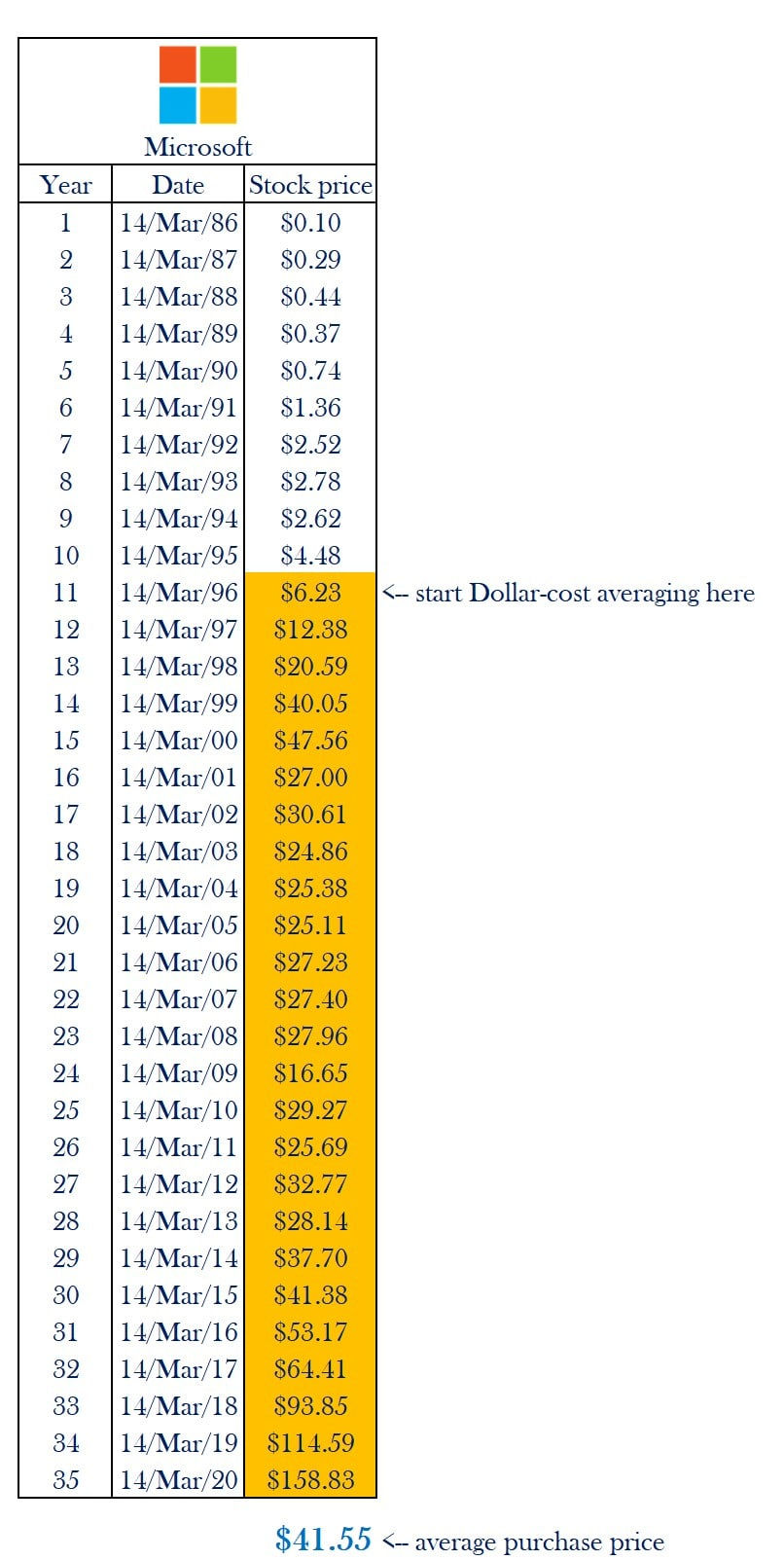

Example: If you would start performing dollar-cost averaging in Microsoft 10 years after they went listed (in 1996) until 2020, your average entry price would be at $41.55

Today (end of 2020) Microsoft is paying a dividend of 1% at their trading price of $222.75 = $2.22 per stock.

Now because your average entry price is at $41.55, your dividend yield will be 5.34% instead ($2.22 divided by $41.55).

And by the time your life presumably ends at 100 years old, you would not have touched your investment capital of $3,961,301 (or $21,850,958 if you stayed invested in the companies) at all.

You can either leave these monies for your next generation, your charity of choice

Or you could withdraw a portion of your investment capital for use if you would like to increase your lifestyle expenses throughout your retirement years.

7. The wonder of Compound interest

This is one of the reasons the rich get richer.

Because they understand and utilize the power of compound interests.

The column bar graph illustrates how rapidly your total gains will compound overtime, even though you just maintain the reasonable (achievable) $305 investment amount every month (or $10 a day).

8. How do you generate up to 15% per year?

Before we proceed, please note that I am a huge proponent of investing for the long-term. And I am very against attempting to “time the market” and engaging in frequent trading (buying and selling of stocks).

There have been too many studies and also attested by my own experience that long-term investing (instead of frequent buying and selling- trading, attempting to time the market) yields the best results over the long run.

Here is a great article about the significance of investing and holding great companies for the long-term.

Warren Buffett’s Berskshire Hathaway averaged about 20% since they began investing in 1965.

However bear in mind that Berkshire managed an average of $40 billion worth of cash in the past 29 years (and an average of $83 billion in the past 10 years).

With a portfolio that large, they would have to invest in larger cap companies for their top holdings

because larger cap companies have higher liquidity and these companies usually do not have that high of a growth rate.

o Hence for average investor like ourselves with smaller amount of investment capitals, it is possible for us to achieve gains higher than 20.5%. since we can invest in smaller cap companies which have increased opportunities in providing higher returns over the long run. Arkk Invest fund (one of the best performing fund out there today) averaged a yearly returns of 30.97% since inception, and they are managing a smaller net asset of $8billion.

https://ark-funds.com/arkk#performance

But as a start, let us set a more realistic figure for ourselves, and aim to achieve at 15% returns per year.

To give you an idea what kind of companies are able to generate up to 15% returns per year: It will be helpful for us to look at some past figures.

Here are some of the most popular companies and brands in the world, and listed below are their respective compounded annual growth rate (CAGR) returns if you would have invested in them 10 years after they went listed. (Assuming you decide to wait it out for the first 10 years- after they went listing- and see if if their business model is really as promising as they claimed to be in the initial stage, plus giving you sometime to do your own due diligence ).

Note: The tables above are showing returns based on purely capital gains only, and did not take into account dividend payouts. So although some of the companies (like Disney and McDonalds) did not achieve 15% yearly CAGR, but with their dividend payouts along the way, their returns would have yielded more than 15% returns per year.

As you can see, I am pretty sure you are rather familiar or would have at least heard of most of the companies in the list. And many of them were actually quite high profile and prominent even at the early stages when they just went public (companies like Amazon, Microsoft, Google, Disney, Starbucks, McDonalds, Walmart, Nike, Adidas, LVMH, Visa, Apple, Intel, Blizzard etc). So identifying great companies to invest in is actually not that difficult, all we need to do is just to look around and pay some attention to the news about the uprising companies with great potential to grow with good fundamentals.

And you shouldn’t worry about “missing the bus”, as you can see in the example above, even if you have “waited” or “procrastinated” for 10 years period of time, you will still get a pretty good return from them when you invest and hold them for the long run.

(Important disclaimer): This doesn’t mean you should go ahead to invest in these companies now (since their future growth potentials going forward are way different) compared to many years ago.

However this section (how to find great companies to add into your portfolio) itself deserve many many other articles by itself, which I will be covering in the future.

9. The growing Goose which lays golden “snowball” eggs.

First of all, I would like to admit that although doable, it is easier said than done to set aside $305 of disposable income every month to be used for long-term investment, especially in difficult times like these where most of us are affected by covid, in forms of pay cuts and/or reduced job security, Furthermore with the additional utility (enjoyment) $305 can bring us every month such as buying new clothes and shoes, and also buying nice treats for ourselves, That makes it even more difficult to resist and discipline ourselves to save the money.

However, to help put you in the right frame of mind be able to see the reward of delay gratification,

if you follow the investment plan and stick to investing $305 every month and compound it at 15% returns per year

You will achieve a gain of $245 at the end of your first year (that is equivalent to 0.8x of your monthly saving amount of $305),

Meaning you actually receive almost 1 month of “free saving” at the end of the year.

By the 2nd year, your gains on the year alone will give you up to 2.71x of “free” monthly savings

And by the 6th year, you would have received up to 13.75x or 1.15 years’ worth of “free” savings per year.

This is when the snowflake becomes the snowball and it starts to roll down the hill and keeps getting bigger in size.

The only difference is these “free” gains are not to be used now, but for later part of your life.

To help you understand better, I will use the “Golden Goose” analogy.

When you start your investment journey, you would have built yourself a Goose which lays “golden snowball eggs” for you periodically.

But instead of laying those golden eggs out, the goose will keep them inside her, causing the goose to grow bigger and bigger overtime. And the bigger it grows, the bigger the eggs it will produce.

Vice versa, if it becomes smaller, it will produce smaller eggs too.

You may choose to remove some of the eggs from it (for your own consumption), but that is going to reduce the size of goose and cause it to produce smaller eggs in the subsequent period - which will not be very favorable for you.

And besides, since the eggs are inside goose, you wouldn’t want to reach inside of it frequently right?

The wonderful thing is, given enough time, there is no limitation on the size that the Goose can grow to.

At one point when the golden goose gets really big, it will start to lay some of the golden eggs out of it’s body (in forms of dividends) which you can use to fund your lifestyle without even needing to intrude the golden goose (your investment capital) at all.

An important disclaimer I would like to make at this point, I am not advocating that you should not spend money and indulge in things which bring you joy in life at all. As your career progresses and you will receive salary increments and bonuses, and you can allocate some of these additional incomes gained into buying and enjoying these things which bring you joy in your life. I found that it can be counterproductive to scrounge all additional incomes and not spending them on things which we enjoy at all, as it may cause willpower depletion and decrease our motivation to remain consistent to our long term financial plan. This is similar to people who set unrealistic expectations and plans to lose weight in the shortest amount of time possible tend to give up halfway and eat to excess once they reached the “tipping point” due to willpower depletion and end up in square one where they started- gaining back all those weight.

Sadly, this will demoralize them and deter them from any attempts to lose weight again in the future. They may be brought into a downward spiral of thoughts like “What is the point of all of these? It is exhausting, and they never work anyway!?” And once someone falls into spiral of negative thoughts, it is usually quite difficult for them to pull themselves out of it.

So, all we really need to do to stay on track to achieve our investment goals is to remain consistent with our saving and investment of $305per month to our investment plan.

You can set up a separate bank account to store all these funds, preferably a bank which is not very popular and does not have a lot of ATMs around so it will more difficult for you to access the funds. Or you can just transfer the $305 into your brokerage account every month when you receive your pay check.

And aim not to cheat, i.e. use the money to buy something else – ie to use those money to buy “treats” for yourselves (especially things which are not contributing to helping you reach your financial goals). If you really want to buy something, you should build the habit of saving for them instead, or find ways to increase your main source of income instead of using the funds which are meant for your monthly investments.

Aim not to engage in frequent trading- active buying & selling in hopes to achieve higher returns.

And as mentioned earlier. Please note that this is not an encouragement for you to perform more frequent trading (buying and selling frequently in hopes for a quick gains) to achieve a higher return. Because active trading is actually not scalable (since it is a form of “active” income), and it doesn’t utilize the potential of compound interest. Besides there are too many studies (and attested by my own past mistakes too!) that frequent trading for short term is still an inferior method when compared to Dollar-Cost Averaging for building wealth.

There are also too many stresses involved in the activity of frequent stock trading.

It requires a lot of active monitoring and needing to pay attention to all the news and “noise” in the market.

Although the high is great when traders make a quick (or sometimes large gains) this will distort their sense of reality, giving them an illusion of grandeur and make them more susceptible to taking huge risks in the future, and in some cases, a lot of their gains may be wiped out in a short period of time due to the *greed and also their distorted perception of them being able to make successful trades consistently.

This is a great video from Chicken Genius, a popular investing youtube channel from Singapore where Ken shared about his past as a day-trader and eventually realized that Dollar-Cost Averaging which is way more of a superior method.

Investing should not be an exciting thing (especially at the beginning), watching your portfolio should be similar to watching the grass grow or watching the paint dry on the wall.

When it comes to investing, consistency (ie through dollar-cost averaging) over the long run and doing it in a proper way is more important than attempting to chase quick and supposedly “easy” gains (which potentially leads to quick losses too).

Closing

In future articles,

I will talk about:

How you should save up for an emergency fund, so you need not touch your “Golden Goose” so it can continue focusing on growing your capital for you.

Some guidelines on how you can identify great companies which have high probability to generate 15% of yearly returns for you.

And how to design your portfolio and the importance of diversifying them

And how many stocks you should have in your portfolio

Endnotes:

Inflation, a silent killer https://icoboosterteam.medium.com/inflation-is-a-silent-killer-8251da70fe09

Table1: Please note that the exact date and prices of these companies may not be completely accurate, since I acquired some of the data from google finance (and they may not show the exact IPO date of certain companies).

Table 1.1: here is another website which can help you to perform the same calculation too https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php But I prefer my own excel sheet attached above since it allows me to see the monthly amount and how the figures change if I increased my monthly savings along the way.

Giant golden goose which knows no limit in size Source of image: Puss in boots movie

Enjoyed this article?

The purpose of this article is to provide readers with new ideas

& hopefully help them make better investment decisions.

If you have derived any value from reading this,

why not share it? :)

Max, just came across your blog now Oct 2024. Was very excited for a while when you talk about ARKK but I checked and it is minus -30% right now. ARKK | The ARK Innovation ETF managed by Cathie Wood (ark-funds.com)

👍 super detailed post Max! Looking forward to your future posts!